The COVID-19 pandemic and its impacts presented a historical opportunity to reform tax and fiscal systems, including global tax rules, to make them work for people and the planet. Tax policies should serve to reduce inequalities, not exacerbate them. Global tax rules should not be biased in favor of elite countries and MNCs’ profit driven agendas. Global tax rules should help to reduce inequalities within and across countries, and “no one should be left behind” in rule making. As representatives of 193 member-states of the United Nations gathered for the 76th session of the UN General Assembly on 14-30 September 2021, the Asian Peoples’ Movement on Debt and Development (APMDD) and allies reiterated their call to make taxes work for women!

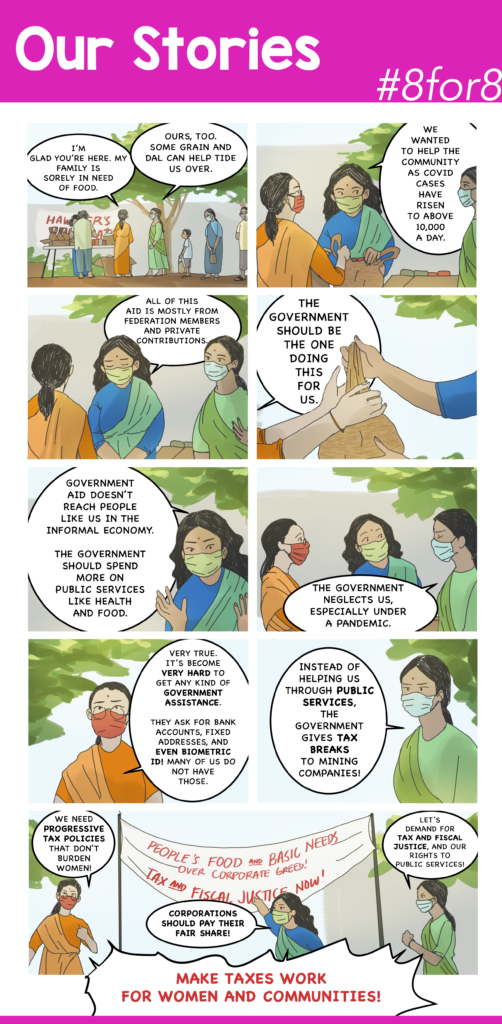

This comic strip is inspired by real stories of APMDD members across the region. As COVID-19 lockdowns brought already marginalized communities to extreme crises of survival, people came together in the spirit of solidarity. Community pantries and kitchens, the delivery of basic necessities to the elderly and others who must keep indoors, among other community-led initiatives, are testament to peoples’ solidarity.

People’s solidarity, however strong and effective, is not a substitute for the State’s responsibility to provide essential public services, especially amidst widening inequalities in Asia. People living in extreme poverty, barely affording a single meal in a day, are estimated to have increased to over 100 million in Asia. Gender inequalities have also deepened with heavier demands on women to provide a disproportionate amount of time on unpaid care work in the midst of greater female unemployment and widening gender wage gaps. Ironically, Asia and the Pacific has also seen rapid growth in wealth by individuals and corporations amounting to over US$ 7.5 billion in 2020 alone.

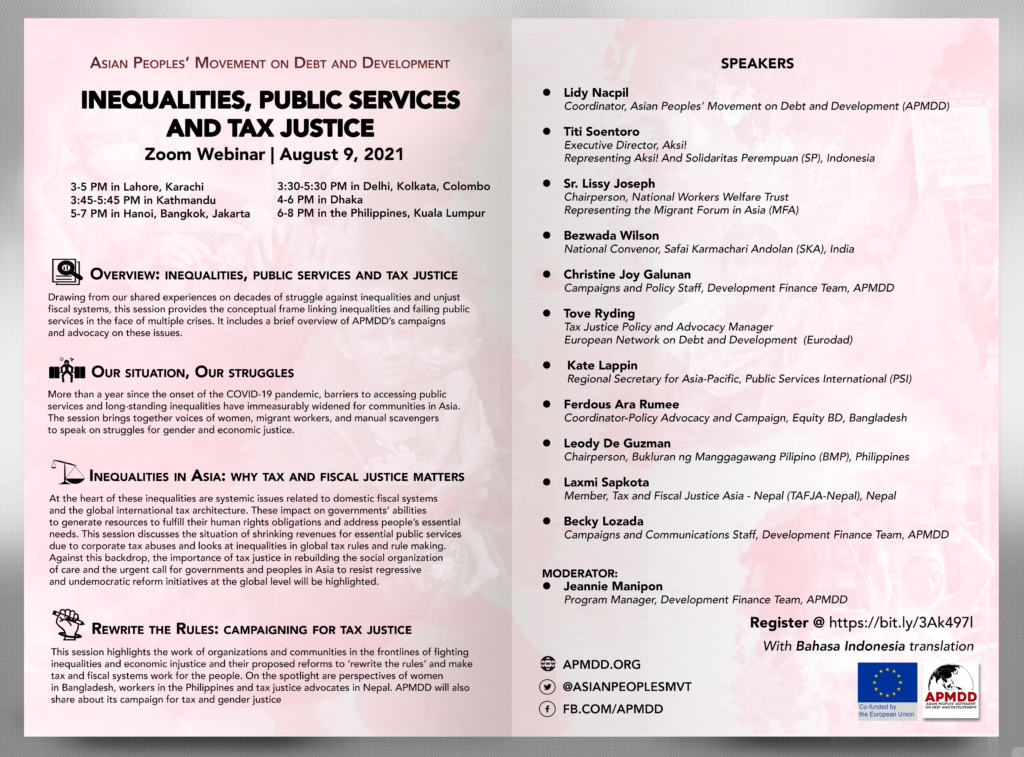

Participants to the Webinar – Inequalities, Public Services and Tax Justice made the sign for equality to cap off a two-hour session that brought together organizations and communities in the frontlines of fighting inequalities and most affected by failing public services and loss of public revenues due to flawed fiscal and tax systems. Over 110 attended the webinar, and learnt about how to strengthen campaigns on tax and fiscal justice especially in light of developments in global, regional, and domestic policy-making.

The webinar aimed to:

• Surface some of the most pressing issues faced by marginalised sectors and communities in the context of failing public services and deepening inequalities;

• Highlight the systemic barriers to making public services accessible and responsive to people’s needs and rights, drawing the links to gaps and flaws in fiscal and tax systems;

• Discuss and collectively analyze key developments in national, regional, and global policy fronts that impact inequalities and people’s access and right to public services; and,

• Facilitate sharing of strategies for advancing tax and fiscal justice agenda, with a focus on public services.

Read more

In response to the Communique of the G20 Finance Ministers Meeting held in Venice on 9-10 July 2021, Asian Peoples’ Movement on Debt and Development (APMDD) Coordinator Lidy Nacpil said that in regard to climate, debt, and tax, the statement is underwhelming and fails to offer any indication that the demands of peoples of the Global South are heard.

Today, the G7 Finance Ministers issued a communiqué announcing their joint agreement on new global tax rules, including a global minimum corporate tax rate and a special new tax on some of the world’s largest corporations.

In response to the G7 agreement, Tove Maria Ryding, Tax Coordinator at the European Network on Debt and Development (Eurodad), said:

“We have three overall concerns with the new global tax measures that the G7 countries are outlining. In essence, they are not fair, they are not ambitious, and there is a high risk they will lead to a more complex and ineffective tax system.”

Ryding also expressed strong concerns about the way the G7 is trying to decide what the global corporate tax system should look like.

“The negotiation about new global tax rules belongs at the United Nations, where all countries can participate on an equal footing, rather than at a small rich countries’ club like the G7.”

Debt audits can be a powerful tool to support civil society engagement in citizen assessment of debt impacts but also to increase citizens’ participation in public finance governance, leading to an increase in accountability and transparency and allowing for the identification of illegitimate debts at the national, regional and municipal level.

This briefing is a general introduction to debt audits, what they can contribute and their main characteristics, while also providing references to manuals and articles on debt audits. It is intended to support civil society organisations (CSOs) and government officials that are thinking about promoting a debt audit by providing some initial ideas about how to initiate this kind of process.

The briefing covers:

- What is a debt audit?

- What we can expect from a debt audit

- What is analysed under a debt audit

- How to start and continue the process

- Difficulties that can be expected

- Previous examples of debt audits

- Resources and more information.