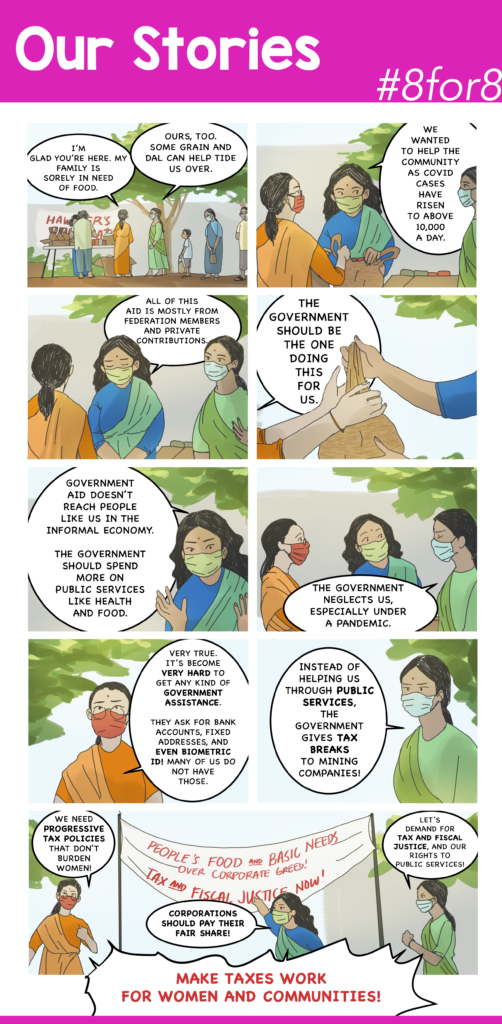

The undervaluation of care and care work is reflected in the gross imbalances and gaps in national budgets and lack of publicly funded care services, support systems for care workers, and physical and social infrastructures needed to reduce and redistribute care work. Care – caring for families, communities, and society as a whole – is an essential need and function of any society; it is not “just a woman’s responsibility,” but the collective responsibility of society.

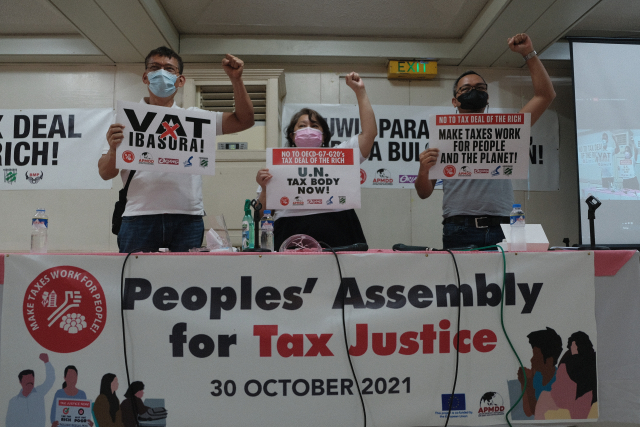

The Asian Peoples’ Movement on Debt and Development (APMDD) advances a comprehensive agenda for tax and gender justice that takes into account the multiple and intersecting layers of discrimination that women in Asia face. The issue brief explains how burdensome Value-added tax (VAT), Goods and Services tax (GST) and Excise tax are to women and all unpaid care workers and has become imperative to advance our five (5) calls and demands.