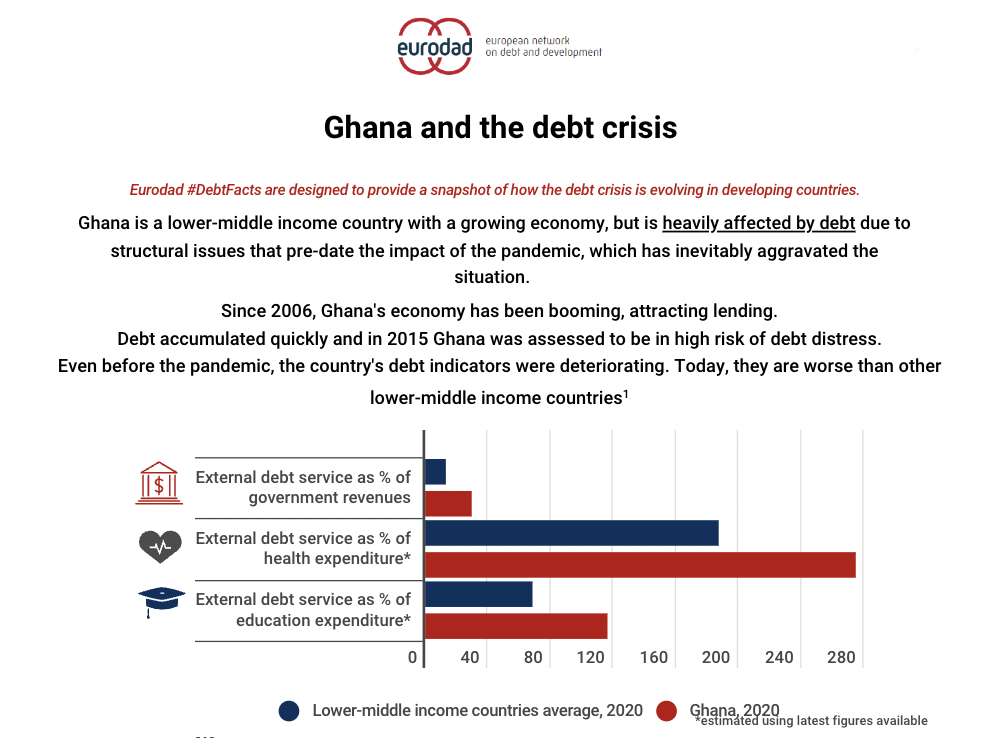

Ghana passed quickly from being the poster child economy for West Africa to being one step away from losing its access to international capital markets.

Click here to see an infographic highlighting why urgent international support and a multilateral, inclusive debt workout mechanism is needed to help the country address its debt burden.

The infographic was published by the European Network on Debt and Development.

On 2 February 2022, NCDHR held a press conference in Delhi to share its analysis on the Union Budget for 2022-23, from the perspective of Dalit and Adivasis – with a particular emphasis on women from these communities.

The conference highlighted the need for economic recovery resulting from the unprecedented pandemic situation, with its particularly harsh impact on marginalised communities.

The panellists emphasised on denial of the budgetary rights of the Dalits and Adivasis and stressed the need to have appropriate allocation for the development of the Dalit and Adivasi communities. The press conference placed a special focus on Dalit women, and particularly sanitation and frontline workers, including gender budget allocations for Dalit and Adivasi women allocations for areas such as higher education and prevention of violence. Subsequently, press conferences were organised across 10 states, and the analysis was widely covered in press reports both at the national and state level in Hindi, English and regional languages (read articles here and here.)

The year 2021 has been a challenging year where hundreds of citizens lost their lives while the country’s health care system succumbed to Covid-19’s second wave. India was gasping for oxygen amidst an out of control unavailability and a crisis of health care facilities. Patients died outside hospitals waiting for beds if at all they had the opportunity to reach there before they lost their battles to Covid-19. However, amidst the global pandemic, while even the most socio-economically privileged section was struggling, how did Dalits and Adivasis manage to support their livelihood and survival?

In Dalit and Adivasi households, especially in villages, the infrastructure required for proper isolation is a luxury. In several states, the isolation camps set up by the government were made inaccessible to Dalits and Adivasis as the dominant castes did not want to share a common space with them, highlighting the broadened caste divide. The hospital bed charges were record high and the poor marginalised communities could not even imagine getting one. Even having access to sanitiser and masks was a distant reality. This is one of the countless forms of discrimination faced by marginalised communities during the pandemic. The crematorium workers, sanitation workers and frontline workers worked ten times more and still were thrown pennies at.

Against this background, the Finance Minister presented the Union Budget 2022 which was expected to take some of these concerns on hand, but it was rather a lack lustre budget. The total allocation for SCs under the Allocation of the Welfare of the SCs (AWSC) is Rs. 1,42,342 Crs and for STs under the Allocation of the Welfare of the STs (AWST) is Rs. 89,265 Crs. The budget revealed the deficiencies in their policies and lack of political commitment to uplift the Dalit and Adivasi communities. When one looks at the quantum and quality of schemes, there is not a single innovative scheme to address the pandemic and the impact of this on the communities.

On 15-22 January 2022, APMDD and its members participated in the Global Protest to Fight Inequality (initiated by the Fight Inequality Alliance). This included activities in Indonesia, India, Bangladesh, Pakistan and the Philippines, around the theme “It’s Time to Tax the Rich”.

Actions ranged from protests by workers and union leaders in the Philippines and dances to the tune of “We Will Tax You” (see Facebook Live stream above), a children’s art exhibit in Pakistan, a human chain in Bangladesh, a package of activities from movie screenings to talk shows, declarations and mural installations in Indonesia, and a discussion forum bringing together around 70 activists, thinkers and leaders in India.

Further details on the actions can be found in this article.

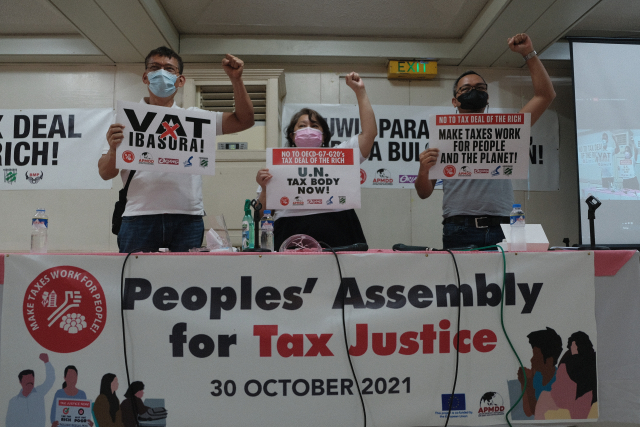

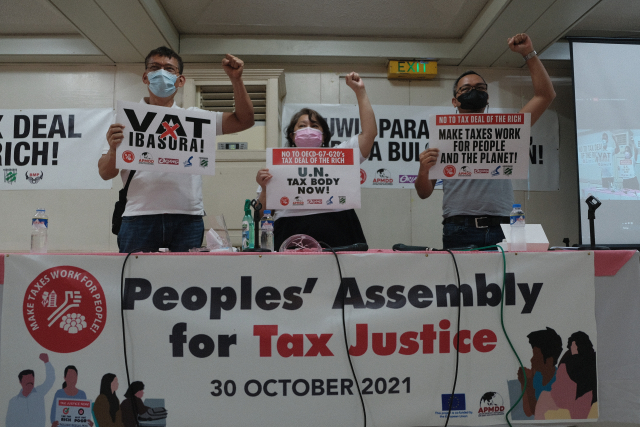

Lidy Nacpil of the Asian Peoples’ Movement on Debt and Development (center) presses for new tax rules to be negotiated in a proposed United Nations Tax Body. Labor Leader Ka Leody De Guzman (left) calls for the scrapping of VAT and institution of a wealth tax in the country. Sanlakas Secretary General, Atty. Aaron Pedrosa, moderated the press conference.

The Asian Peoples’ Movement on Debt and Development (APMDD) today slammed the 15% minimum global corporate tax rate jointly proposed by the Organisation for Economic Co-operation and Development (OECD), G7, and G20, calling it the “tax deal of the rich” and instead called for the creation of a tax body under the United Nations (UN).

“Under the guise of, or pretending to be helpful as part of COVID-19 and multiple crises responses, the OECD, which is the organization of 37 wealthiest countries in the world, in collusion with the G7 and G20, are now putting forward and promoting a tax deal that will actually result in more benefits for corporations and governments of wealthy countries rather than the Global South,” APMDD coordinator Lidy Nacpil said.

“We are taking this occasion to express our rejection because in a few hours, the G20 will be convening its summit, and this is an important time to raise our voices,” she added.

This document is an introductory briefing of the Financing for Development (FfD) process and of the Civil Society FfD Mechanism’s role in it.

By guiding readers through the UN Financing for Development world, it shines a light onto how shaping decision-making on global economic governance at the UN has the potential to transform our global economic systems to reduce inequalities within and between countries and make them work for people and the planet.

This guide was developed based on collective work by the Civil Society FfD (Financing for Development) Group, and is available in Arabic, English, French, German, Spanish and Russian.

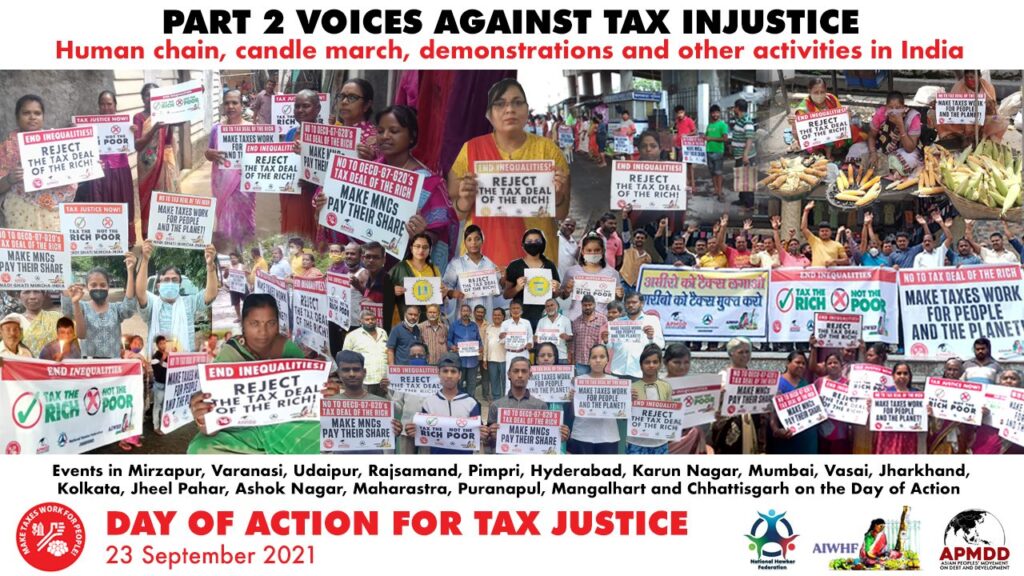

From 23 to 24 September 2021, APMDD members were mobilised to participate in Global Days of Action for Tax Justice (see also the video montage here).

This included actions in several countries. In India, activists participated in a photo action, candlelight march, human chain, and the press statement “India should stop this race to the bottom of corporate taxation” was released. Plus, a photo action took place in Bangladesh, and a photo action by fisherfolk and a press conference was organised in Pakistan