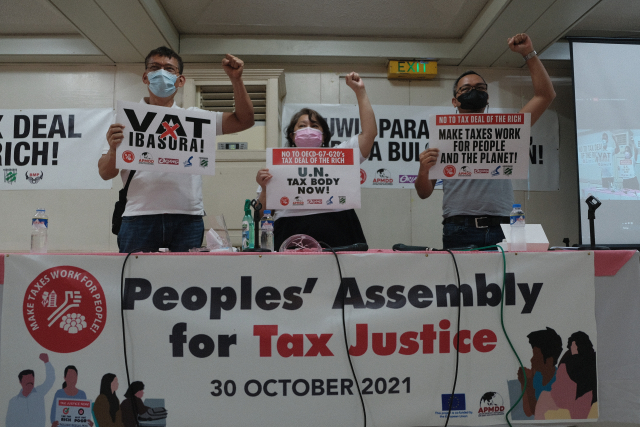

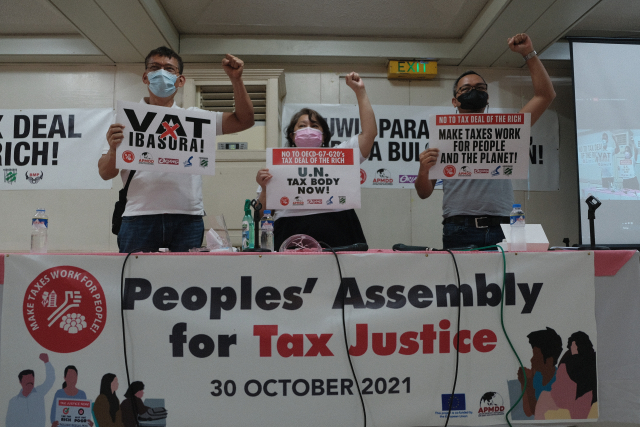

Lidy Nacpil of the Asian Peoples’ Movement on Debt and Development (center) presses for new tax rules to be negotiated in a proposed United Nations Tax Body. Labor Leader Ka Leody De Guzman (left) calls for the scrapping of VAT and institution of a wealth tax in the country. Sanlakas Secretary General, Atty. Aaron Pedrosa, moderated the press conference.

The Asian Peoples’ Movement on Debt and Development (APMDD) today slammed the 15% minimum global corporate tax rate jointly proposed by the Organisation for Economic Co-operation and Development (OECD), G7, and G20, calling it the “tax deal of the rich” and instead called for the creation of a tax body under the United Nations (UN).

“Under the guise of, or pretending to be helpful as part of COVID-19 and multiple crises responses, the OECD, which is the organization of 37 wealthiest countries in the world, in collusion with the G7 and G20, are now putting forward and promoting a tax deal that will actually result in more benefits for corporations and governments of wealthy countries rather than the Global South,” APMDD coordinator Lidy Nacpil said.

“We are taking this occasion to express our rejection because in a few hours, the G20 will be convening its summit, and this is an important time to raise our voices,” she added.

Read the full press release.