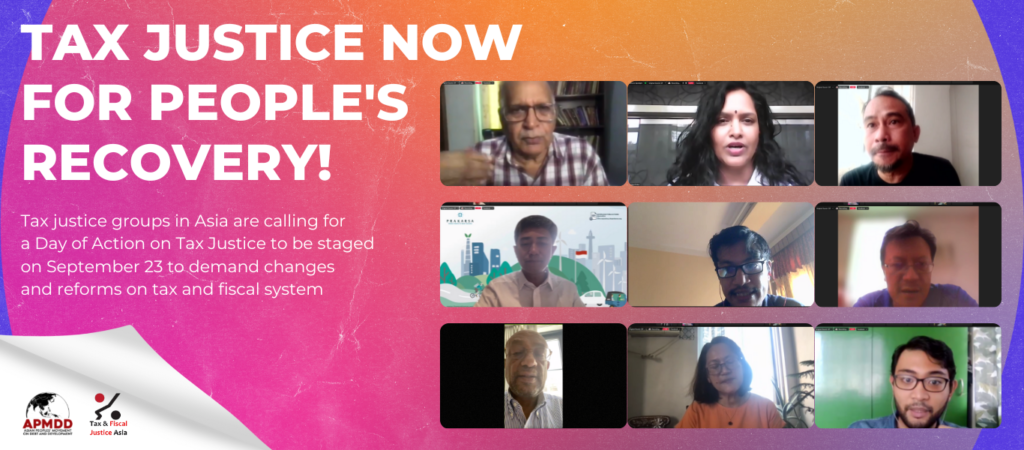

Tax justice groups in Asia are calling for a Day of Action on Tax Justice to be staged on September 23 to demand changes and reforms on taxes and fiscal system with Jeannie Manipon of The Asian Peoples’ Movement on Debt and Development (APMDD) saying that “national tax systems are biased in favor of MNCs and the elites. We can also see the similar pattern in the international tax system”, emphasizing that a progressive mechanism must be put in place in order to allow the removal of the backwards tax and fiscal system.

In an online press conference organized by the Tax and Fiscal Justice – Asia (TAFJA), the combined and resounding messages of speakers stressed that regressive tax policies exemplified by VAT and GST impact women, workers, farmers and other marginalized sectors the most and severely undermine their capacities to prepare for, respond to, survive recover and rebuild when crisis or natural disasters strike. Regressive tax systems, with their elite and gender biases are legacies of colonialism, part of systems that enable countries of the Global North to extract wealth from the Global South.