Today, the G7 Finance Ministers issued a communiqué announcing their joint agreement on new global tax rules, including a global minimum corporate tax rate and a special new tax on some of the world’s largest corporations.

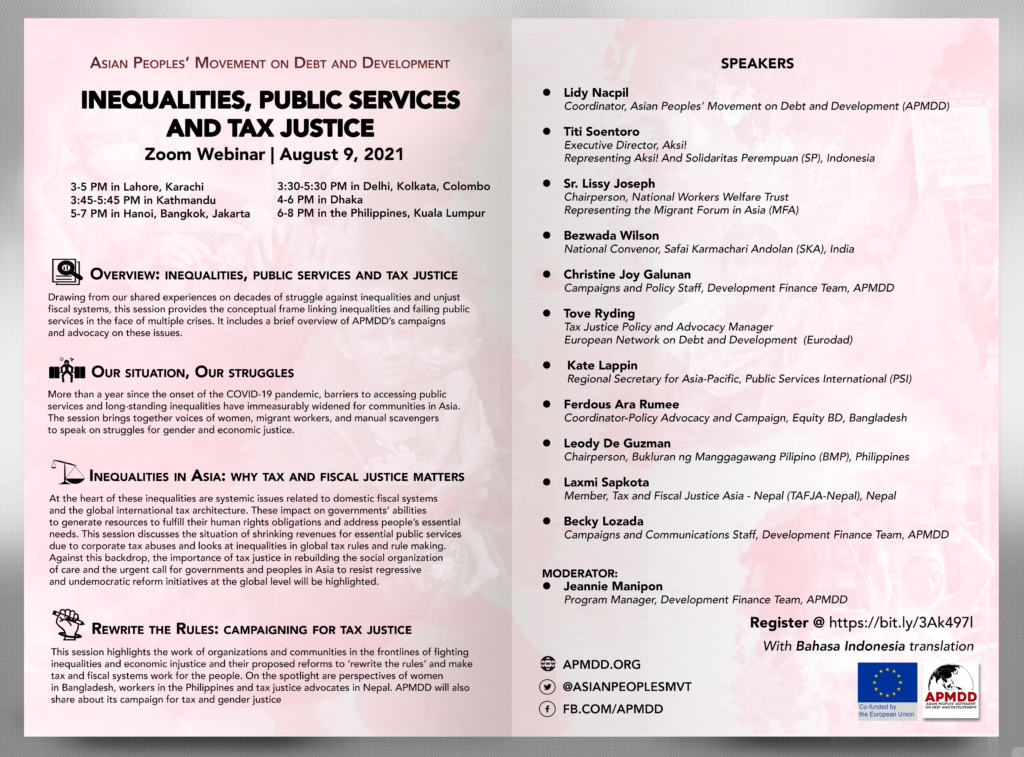

In response to the G7 agreement, Tove Maria Ryding, Tax Coordinator at the European Network on Debt and Development (Eurodad), said:

“We have three overall concerns with the new global tax measures that the G7 countries are outlining. In essence, they are not fair, they are not ambitious, and there is a high risk they will lead to a more complex and ineffective tax system.”

Ryding also expressed strong concerns about the way the G7 is trying to decide what the global corporate tax system should look like.

“The negotiation about new global tax rules belongs at the United Nations, where all countries can participate on an equal footing, rather than at a small rich countries’ club like the G7.”

Read the full press release