During the webinar speakers discussed perspectives and demands of movements in the global South for debt cancelation and debt relief, as well as for tax justice to respond to multiple crises and rising inequalities, looking at both cases of national tax agendas and the global tax architecture.

Webinar “Wealth Tax for Tax Justice: A Call Whose Time Has Come!”

As inequality and poverty grow in the Philippines, in Asia, and across the globe, so too does the call for a wealth tax.

A wealth tax is a potent tool for equality and justice. A wealth tax is a tax on the market value of assets owned by an individual taxpayer rather than on his/her income. Taxable assets may include cash, bank deposits, shares, land, real property, cars, and furniture. By taxing the wealth of high net-worth individuals and not just income, governments will be able to raise more domestic revenues for funding essential public services that are needed so urgently today.

Groups based in the Philippines calling for a wealth tax are advocating for one of the most direct ways to stem inequality by reversing the highly regressive tax system that governments across Asia have long depended on to sustain basic public services. Regressive taxes such as Value-Added Tax (VAT) and excise taxes have long been known to hit those with smaller incomes harder, and have thus helped to widen the gap between poor and rich, women and men, marginalized sectors and influential elites.

A statement of solidarity with the youth of Asia and beyond in their struggle to end inequalities and fight for just, equitable, fair societies compatible with a healthy planet. The statement calls for an end to abusive tax practices and illicit financial flows and demands that governments adopt progressive tax policies to increase capacities for generating revenue. Furthermore, it demands that governments take urgent and decisive actions for pro-youth and pro-people socio-economic development.

The undervaluation of care and care work is reflected in the gross imbalances and gaps in national budgets and lack of publicly funded care services, support systems for care workers, and physical and social infrastructures needed to reduce and redistribute care work. Care – caring for families, communities, and society as a whole – is an essential need and function of any society; it is not “just a woman’s responsibility,” but the collective responsibility of society.

The Asian Peoples’ Movement on Debt and Development (APMDD) advances a comprehensive agenda for tax and gender justice that takes into account the multiple and intersecting layers of discrimination that women in Asia face. The issue brief explains how burdensome Value-added tax (VAT), Goods and Services tax (GST) and Excise tax are to women and all unpaid care workers and has become imperative to advance our five (5) calls and demands.

Di luar W20 Summit, pada 20 Juli, para perempuan adat Toba dan sejumlah aktivis membentangkan spanduk raksasa bertuliskan “Perempuan Sumatera Utara Lawan Deforestasi” di danau Toba dan sejumlah poster aksi di atas kapal yang merupakan bentuk ekspresi keresahan atas pembahasan dalam pertemuan W20 yang tidak menyentuh persoalan ketidakadilan ekonomi yang dialami perempuan Indonesia, terutama perempuan adat. Pertemuan ini sesungguhnya digelar hanya untuk melahirkan kebijakan-kebijakan yang lebih menguntungkan elit ekonomi dan politik tingkat negara, korporasi dan lembaga keuangan internasional, dan bukan membahas kepentingan rakyat sesungguhnya.

Side event to the UN High-Level Political Forum on Sustainable Development, the webinar was organised by the Global Forum of Communities Discriminated on Work and Descent (GFoD) and Global Call to Action Against Poverty (GCAP). The event focused on the discussion on “Building forward better” around four interlinked themes – vaccines, hunger, debt and social protection, and livelihood while discussing it in context of the achievement of the SDGs, especially SDG 5 using the gender lens.

Watch the video

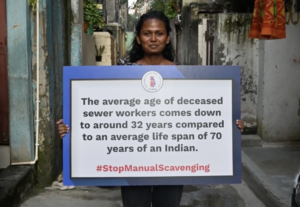

Side event to the UN High-Level Political Forum on Sustainable Development (UN HLPF), this Communities Discriminated on Work & Descent (CDWD) People’s Assembly was facilitated by the Global Forum of Communities Discriminated on Work and Descent, with NCDHR’s leadership.

Participants discussed achievements and obstacles regarding the rights of communities discriminated by work and descent. The forum brought together 39 CDWD rights experts, activists, and other country representatives, and had four aims:

1) to recognise the numerical strength and geographical spread of CDWD communities and the gravity of the discrimination they face;

2) to assess the level of response from individual and collective States Parties in eradicating such discrimination and violence;

3) to explore how the CDWD communities can be formally brought within the ambit of the UN Charter Bodies; and

4) to explore ways and means of generating support from the Foreign Missions

Watch the video of the meeting

Berangkat dari hasil-hasil konsultasi di berbagai kotatersebut, kajian pustaka ini melihat definisi kemiskinandari berbagai perspektif, seperti dari pemerintah, lem-baga keuangan internasional, akademisi dan aktivisperempuan; menganalisis kausalitas (sebabakibat) situ-asi ketimpangan tersebut dari kerangka analisis feminis;dan menyorot program-program untuk mengentaskankemiskinan yang ternyata tidak menyentuh akar penye-bab kemiskinan itu sendiri. Banyak program bantuanmengentaskan kemiskinan lewat lembaga keuangan in-ternasional nyatanya memiliki agenda kepentingan eks-ploitasi sumber daya alam Indonesia dan menjamin pa-sokan ke pasar global.

Kajian pustaka mengenai ketimpangan gender danekonomi ini diharapkan dapat memicu narasi alternatifterhadap narasi arusutama mengenai pembangunandan pengentasan kemiskinan yang berlaku, dan memicugagasan-gagasan narasi yang lebih memihak kepadakepentingan rakyat, termasuk para perempuan.

Currently, a third of the world’s countries are not at the table when global tax rules get decided. It’s time for the United Nations to take the lead, so all countries can participate on an equal footing.

Click here to learn more about the proposal for a UN Tax Convention.