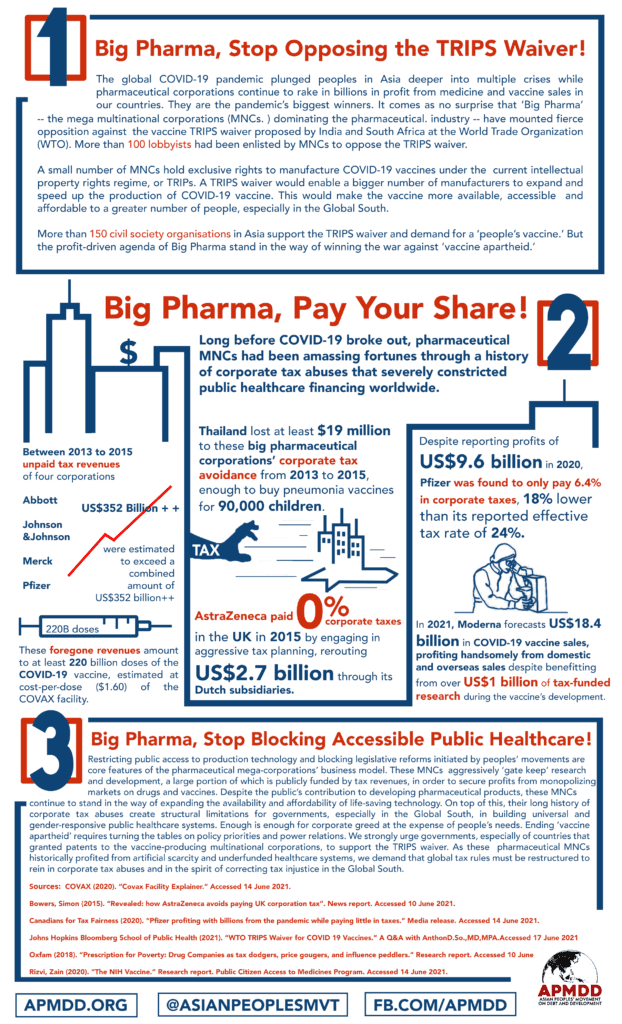

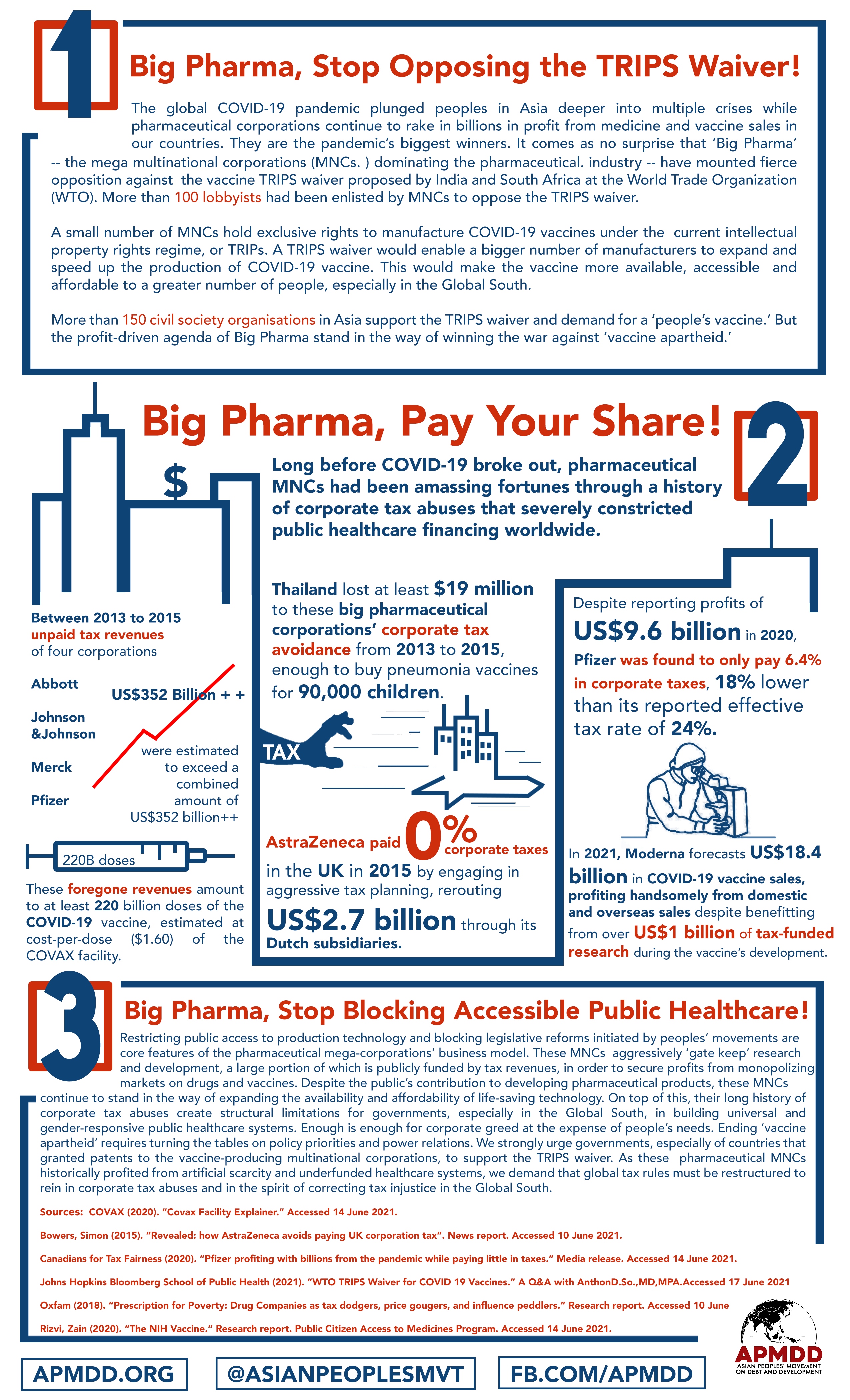

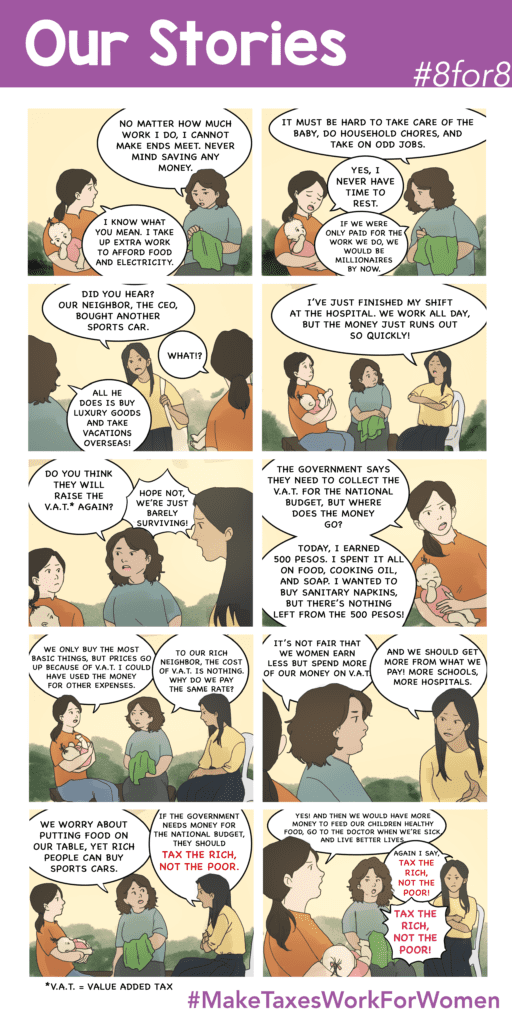

The COVID-19 pandemic and its impacts presented a historical opportunity to reform tax and fiscal systems, including global tax rules, to make them work for people and the planet. Tax policies should serve to reduce inequalities, not exacerbate them. Global tax rules should not be biased in favour of elite countries and MNCs’ profit driven agendas. Global tax rules should help to reduce inequalities within and across countries, and “no one should be left behind” in rule making. As representatives of 193 member-states of the United Nations gathered for the 76th session of the UN General Assembly on 14-30 September 2021, the Asian Peoples’ Movement on Debt and Development (APMDD) and allies reiterated their call to make taxes work for women!