Selama pandemi COVID-19 melanda hampir seluruh negara di dunia, perekonomian pun ikut terpuruk, tak terkecuali sektor pariwisata. Pulau Bali sebagai destinasi wisata utama wisatawan mancanegara, sangat merasakan keterpurukan ekonomi tersebut.

Pandemi COVID-19 mengakibatkan turunnya tingkat kunjungan wisatawan ke Bali yang tentunya berpengaruh pula pada pendapatan masyarakat, terutama para pekerja pariwisata. Berdasarkan data yang dirilis Badan Pusat Statistik Provinsi Bali, bahkan Bali pernah berada dalam posisi nol kunjungan wisatawan asing. Kondisi tersebut membuat para pekerja pariwisata yang jumlahnya sangat dominan, harus berjuang dan mencari cara untuk tetap bertahan dan memenuhi kelangsungan hidup keluarga.

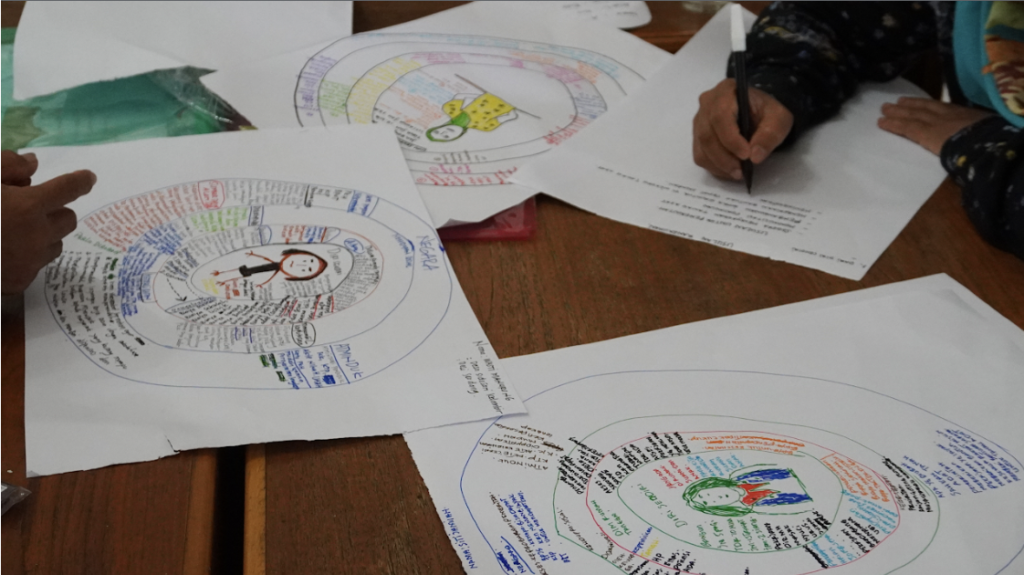

Hal serupa juga dirasakan perempuan Bali. Dalam kondisi yang sangat sulit ini, mereka harus ikut berjuang dan turut memikirkan perekonomian keluarga. Perempuan Bali menjalankan peran gandanya, selain memenuhi kewajiban domestik, juga mencari jalan untuk menambah pendapatan keluarga, baik dengan berjualan makanan, membuat kerajinan, bahkan mencoba hal-hal baru di luar kebiasaannya.

Baca selengkapnya (Link 1) | Link 2