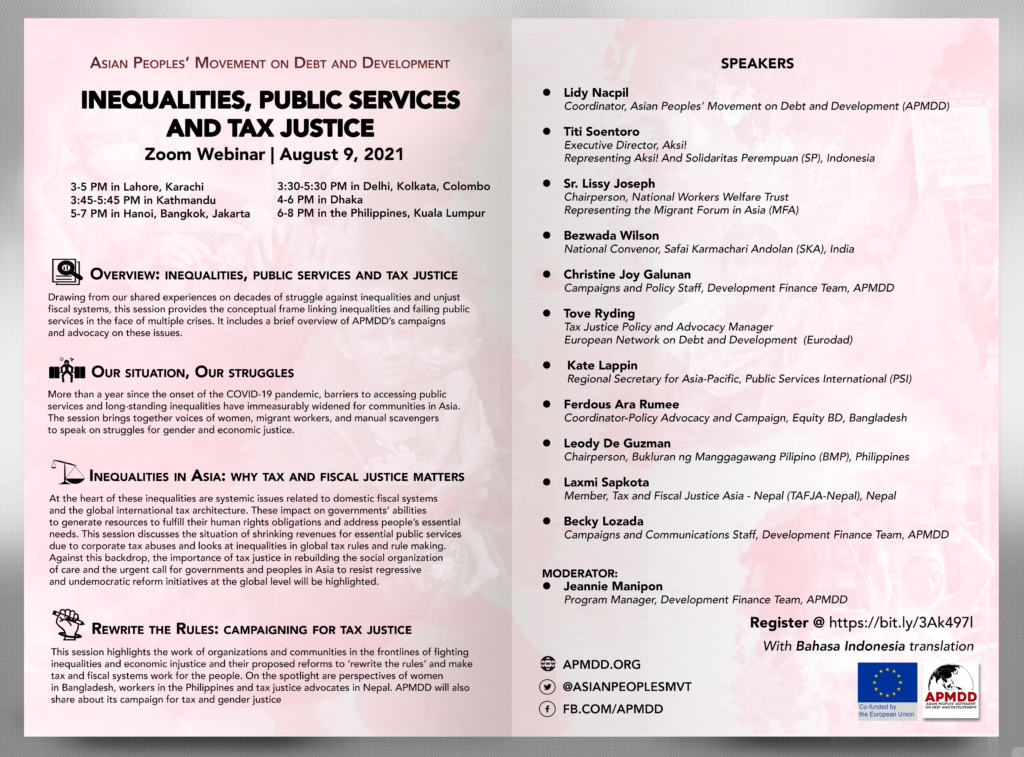

Participants to the Webinar – Inequalities, Public Services and Tax Justice made the sign for equality to cap off a two-hour session that brought together organizations and communities in the frontlines of fighting inequalities and most affected by failing public services and loss of public revenues due to flawed fiscal and tax systems. Over 110 attended the webinar, and learnt about how to strengthen campaigns on tax and fiscal justice especially in light of developments in global, regional, and domestic policy-making.

The webinar aimed to:

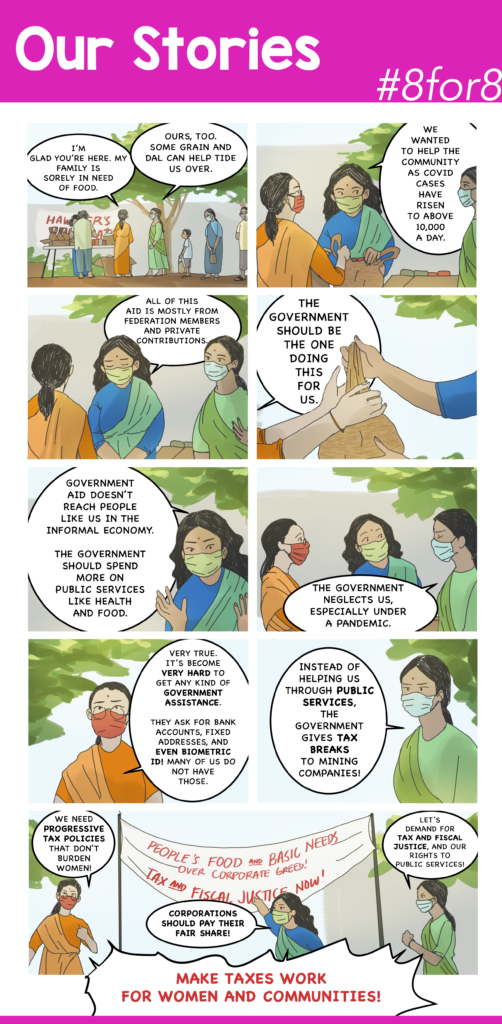

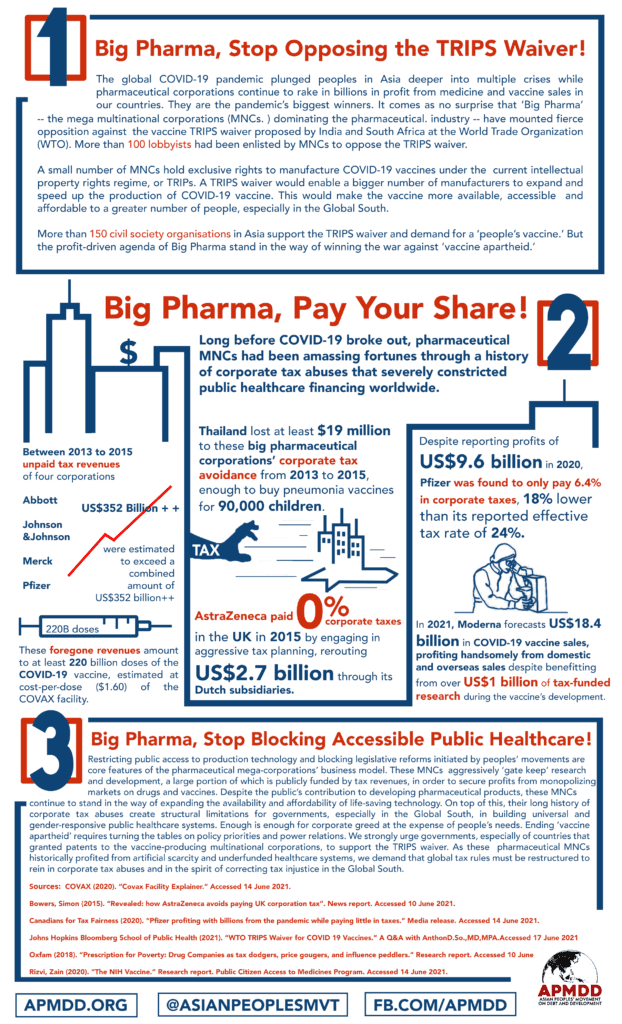

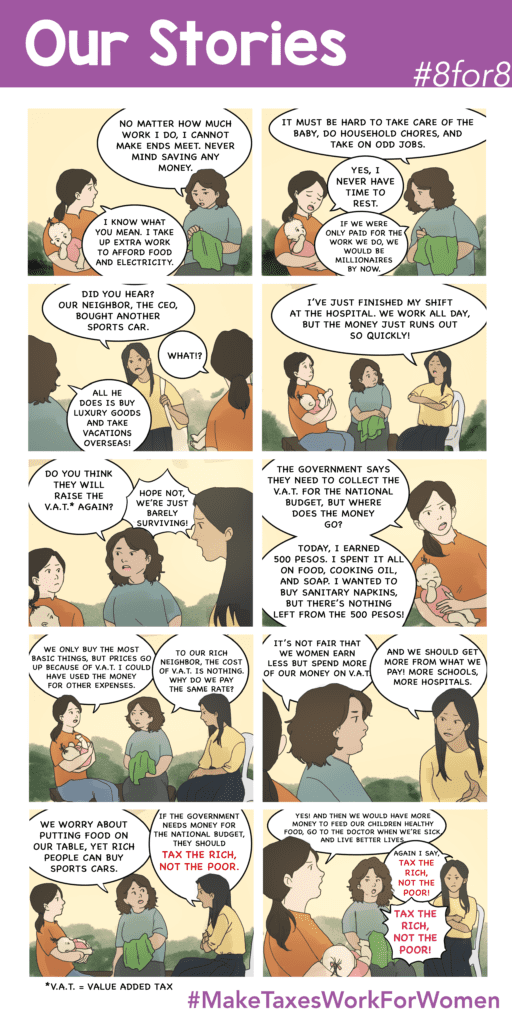

• Surface some of the most pressing issues faced by marginalised sectors and communities in the context of failing public services and deepening inequalities;

• Highlight the systemic barriers to making public services accessible and responsive to people’s needs and rights, drawing the links to gaps and flaws in fiscal and tax systems;

• Discuss and collectively analyze key developments in national, regional, and global policy fronts that impact inequalities and people’s access and right to public services; and,

• Facilitate sharing of strategies for advancing tax and fiscal justice agenda, with a focus on public services.